Thank you for Subscribing to Insurance Business Review Weekly Brief

Insurance Business Review: Specials Magazine

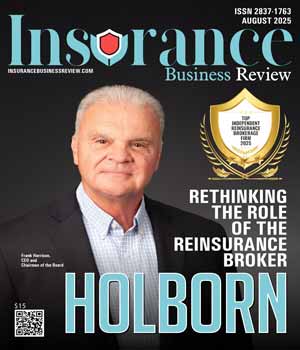

Insurance risks no longer follow familiar patterns, and neither can their protection strategies. Climate volatility is reshaping the underwriting lens. Storms today are no longer linear events with predictable damage patterns. Slight deviations in storm trajectory—say, 20 miles east or west—can drastically alter impact zones, exposing what was previously modeled as a low-risk event. For insurers, this means traditional risk models, built on historical loss averages and regional probability curves, are quickly losing their predictive power. A portfolio that looks insulated on paper can even trigger billion-dollar claims from a single atmospheric anomaly In this environment, how do you price and prepare for future risk? That’s why the role of the reinsurance broker is being redefined. It’s no longer about placing coverage based on precedent. The new mandate is sharper; help carriers see the full extent of their exposure, understand how deep the losses could run and design reinsurance structures to withstand real-world pressure. Holborn answers those mandates with intent. As the only fully employee-owned reinsurance broker in the U.S., Holborn draws on more than a century of experience that refuses to default to off-the-shelf thinking. Rather than pushing templated solutions, it works closely with insurers to build reinsurance programs grounded in real-world data, tailored risk appetites and forward-looking strategy. It all begins with advanced catastrophe modeling. Holborn combines commercial and proprietary tools to assess both the likelihood of events and the full severity potential. Their loss scenarios use both deterministic and stochastic models to reveal the realistic, tail-end impact of risk. These analytics go beyond probability by simulating hurricanes, earthquakes, wildfires and other major events. This approach changes the conversation. It helps insurers answer tough questions, such as: "How much risk can we afford to tolerate?" "Where should we layer protection? Would our capital position hold under stress?" And perhaps most importantly: "Does this program still function properly when the risk assumptions are broken?" “It’s not about placing a policy and moving on,” says Frank Harrison, chairman and CEO. “It’s about making sure the structure we build performs when the market is strained and the pressure is real.” Once the risks are modeled, the focus shifts to aligning strategy with the changing contours. Whether advising on aggregate limits, regional variance or capital efficiency, Holborn’s goal is to ensure every program stands strong against the unpredictable. ... Read More

Top Commercial Insurance Service 2025

For over 15 years, LG Insurance Agency has helped businesses and high-net-worth individuals do more than just buy insurance. It helps them build smarter protection strategies that reduce exposure, improve compliance and minimize costly claims. With a strong focus on often-overlooked areas like employment practices liability and cyber insurance, it empowers clients to proactively manage risk through a truly client-first model. By embedding insurance within a broader risk-reduction framework, LG Insurance takes a consultative approach to offering a full spectrum of solutions tailored to both commercial and personal needs. On the business side, it provides coverage for general liability, group programs, cyber risk, professional liability and workers’ compensation. For individuals and families, it offers life, auto and homeowners insurance, along with customized policies for high-net-worth clients. Given the complexity of today’s insurance landscape, especially in the middle-market commercial space, LG Insurance follows structured processes that streamline audit preparation, strengthen compliance and ensure clear communication at every step. These processes are powered by advanced technologies that track claims trends, automate key documentation and flag potential audit risks early. Clients also benefit from hands-on audit support, including classification-code reviews, payroll reallocation, annual coverage assessments and full compliance readiness. “We cut through audit complexity with smart processes and modern tech, making compliance smoother, faster and far less stressful for every client,” says Aaron Levine, founder and CEO. A certified insurance counselor, Levine brings deep industry expertise and strategic insight to every client engagement. Backed by a team with decades of combined experience, LG Insurance continuously sharpens its approach, guided by real-world insight and a proven ability to solve complex client challenges. A defining strength of LG Insurance is its strategic use of advanced technology to elevate service delivery and ensure audit and underwriting compliance. It leverages platforms such as Mineral for HR compliance, Zenjuries for claims management and YellowBird for workplace safety, providing services like on-site loss-control visits, pre-OSHA inspections and safety assessments. Additional technologies are tailored to each client’s specific needs to streamline renewals, applications and audits. ... Read More

Top Independent Reinsurance Brokerage Firm 2025

Founded in 1930, Johnson & Johnson, Inc. has grown from a modest enterprise into a respected leader in the independent wholesale brokerage industry. The company’s enduring success is built on a solid foundation of trust, accountability, and a steadfast commitment to client service. Rather than relying on grandiose mission statements or elaborate branding, Johnson & Johnson, Inc. distinguishes itself through clarity of purpose and a consistent track record of performance. Its nearly century-long legacy is not merely a testament to longevity but a reflection of its ability to evolve while staying true to core values. “At Johnson & Johnson, culture is a deeply embedded operational ethos that drives decision-making and client relationships, serving as a guiding principle that shapes our day-to-day operations and long-term strategy,” says Francis Johnson, chairman and CEO. That culture—grounded in trust and accountability—is visible at every level of the organization. It’s also what fuels Johnson & Johnson’s long-standing relationships with agents and carriers. State and territory managers are embedded in local markets, giving the company the flexibility and insight to serve clients in a way that national firms often can’t. But while relationships are the company’s backbone, technology is its growth engine. Over the past several decades, Johnson & Johnson has invested heavily in building proprietary systems designed to streamline service and empower its partners. Unlike many in the wholesale space who rely on off-the-shelf software, Johnson & Johnson builds its own tools, allowing it to respond faster and customize more effectively. One early move that helped distinguish the firm was implementing Direct Bill functionality long before it became a trend in the wholesale sector. The system, which mirrors practices more common in the admitted market, created a smoother, more efficient billing experience for agencies and insureds. That, combined with the company’s ability to provide policy-level download data, has significantly improved the service environment for independent agents. Peter M. Burrous, its chief marketing officer, believes the company’s success in technology is rooted in how closely it listens to its customers. “We develop our platforms in-house because we want to own the full customer experience,” he says. “Every product we roll out is driven by what our agents and carriers need—not what the market says we should be doing.” ... Read More

CXO INSIGHTS

From Insight to Impact: Turning Analysis into Outcomes

Casey Averett, Director, Claims Operations and Strategy, the General

Beyond the Basics: Unveiling the Hidden Gems of Commercial Insurance for General Contractors

Bogdan Laza, Vice President | Complex Risk Commercial Insurance Consultant, Brown & Brown

Insurance Claims Amid Labor Shortages: Trucking And Logistics

Preston LaFrance, Director of Claims, One80 Intermediaries

The Impact of Insuretech Advancements Overcoming Industry Challenges and Educating Clients For Optimal Coverage

Cynthia Seagrave, Executive Vice President/Broker - Professional, Cyber and Management Liability, RT Specialty

Futureproofing Claims Careers: Adapting to AI in Insurance

Cade Williams, Assistant Vice President, Risk Management-Claims, Marriott Vacations Worldwide[NYSE: VAC]

Empowering Broker Relationships: A Client's Perspective

Heather C. Pegram, Director, Global Insurance Risk Management, Hanesbrands Inc

Defending Broker Liability Claims

Penny Sturdevant, Director of Claims, STG Logistics

IN FOCUS

Commercial Insurance in Transition: Navigating New Risks and Realities

The commercial insurance market is expanding due to increasing business risk awareness and technological advancements, necessitating specialized coverage and compliance with evolving regulatory requirements.

Independent Brokers in a Fragmented Reinsurance Landscape

Independent reinsurance brokers play a crucial role in risk transfer, leveraging market knowledge and technology to provide tailored solutions, navigate evolving risks, and connect clients with diverse capital sources.

EDITORIAL

The Forces Redefining Insurance

This surge is being fueled by a convergence of powerful tech trends. Digital innovation is transforming how firms operate and interact with clients, making processes faster, smarter and more accessible. AI-powered underwriting is enabling more precise risk assessment, reducing turnaround times and improving profitability. Embedded insurance is creating new revenue streams by integrating coverage directly into digital platforms and customer journeys. Meanwhile, climate risk is reshaping how insurers and reinsurers model exposures, pushing the industry to rethink long-standing assumptions about frequency, severity and protection strategies.

This edition of Insurance Business Review brings recent developments in the wholesale, commercial and reinsurance spaces, offering insights into how the industry is adapting and advancing in the changing landscape.

It features thought leadership articles from industry experts, including Roy Hock, director of risk finance and casualty insurance at Valero and Ruben Pinto, director of large loss casualty, Allstate who share their insights on industry trends, challenges and the road ahead.

It also features Holborn, a fully employee-owned reinsurance brokerage firm that specializes in designing customized, data driven reinsurance programs for U.S. property and casualty insurers.

We hope this edition provides valuable perspectives and practical insights to help you navigate the shifting terrain of insurance and risk management with greater clarity, confidence and strategic focus.